Remuneration 2024

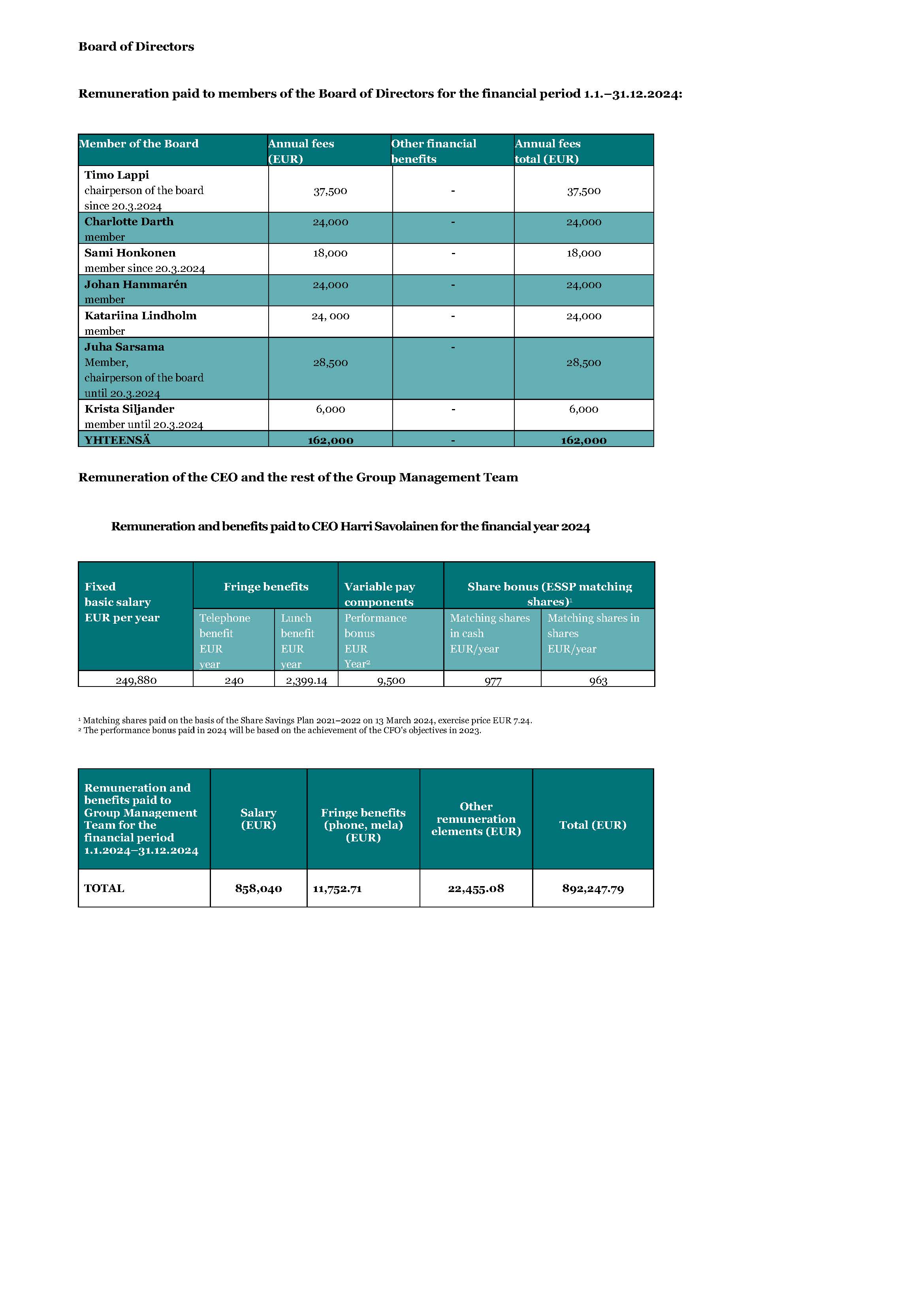

The Annual General Meeting of Fondia Plc decided on 20 March 2024 on the remuneration of the members of the Board of Directors as follows:

EUR 3 500 per month will be paid to the Chairperson of the Board of Directors and EUR 2 000 per month to the other members of the Board of Directors. Travel expenses will be reimbursed in accordance with the maximum amount of the current travel allowance base set by the Tax Administration. The remuneration of the Board of Directors was not increased compared to the previous year.

Remuneration of the CEO for the financial year 2024

The cash salary of the CEO is EUR 20 000 per month gross (from 1 April 2024).

In addition, the CEO receives the usual fringe benefits (e.g. telephone and lunch allowance).

The maximum bonus is a fixed cash salary of four months, the Board of Directors decides on the bonus targets separately each year.

The CEO participates in the first performance period 2022-2024 and the third performance period 2024-2026 of the company's long-term share-based commitment and incentive plan ("share plan"). For each of the two performance periods, the maximum number of shares the CEO can receive is 10,133 shares in Fondia. The performance shares will be paid out at the end of the performance period by the end of May 2025 for the 2022-2024 performance period and by the end of May 2027 for the 2024-2026 performance period.

The CEO must hold at least one quarter of the shares he receives under the share plan until the total value of his shareholding in the company equals half of his annual salary for the previous year. This number of shares in Fondia Plc must be held for as long as his membership of the Group Management Team continues.

The CEO has no specific agreements on retirement age or other pension arrangements.

The notice period for the termination of the CEO's contract is six months and the severance payment corresponds to six months' fixed cash salary.

Remuneration in 2024

Click here to view Fondia''s Remuneration Report 2024.

The remuneration of the CEO and the Group Management Team is in line with the principles of the remuneration policy.

CEO Harri Savolainen

Harri Savolainen, MBA, was the CEO of Fondia for the financial year 2023. The remuneration of the CEO in the financial year 2024 consisted of a base salary and fringe benefits, as well as bonus payments linked to the achievement of business objectives.

The CEO was also paid a share bonus in spring 2024 based on the 2021–2022 savings period of the Employee Share Savings Plan (ESSP), part of which was paid in shares and part in cash to cover taxes. The gross amount of the CEO's additional shares based on these savings was 270 shares, of which 133 shares were delivered to the CEO and EUR 977 for taxes, corresponding to 135 shares. In addition, 422.5 additional shares (gross) are expected to be issued to him in 2025 based on the savings period 2022–2023. The number of any additional shares to be issued for the later savings periods will be determined at a later date.

The CEO does not have a personal remuneration system based on shares or options or other special rights entitling to shares. The CEO participates in the first performance period 2022–2024 and the third performance period 2024–2026 of the company's long-term share-based commitment and incentive plan ("share plan").

The purpose of the share plan is to promote the achievement of the company's financial objectives and to provide a competitive long-term incentive scheme for selected participants. In this way, the objective is to increase shareholder value. The aim is also to achieve broad employee participation in the scheme, which means that, in principle, no one can participate in two consecutive vesting periods. The share plan is performance-based and consists of vesting periods of three financial years. For both the 2022–2024 and 2024–2026 performance periods, awards will be based on the development of the Fondia Group's EBIT and total shareholder return (TSR) during the performance period. For each of the two performance periods, the maximum number of shares the CEO can receive is 10,133 shares in Fondia. In accordance with the terms of the plan, performance shares will be paid out at the end of the performance period by the end of May 2025 for the 2022–2024 performance period and by the end of May 2027 for the 2024–2026 performance period.

The CEO has access to the usual employee benefits such as sports and cultural benefits and occupational health care.

Remuneration of the rest of the Group Management Team

Compensation for the rest of the Group Management Team consists of a base salary, fringe benefits and a calendar-year bonus linked to the achievement of business objectives. The bonus for the members of the Group Management Team is limited to 25% of the annual salary. The Group Management Team is part of Fondia Plc's general bonus scheme, the amount and objectives of which are decided annually. The targets are determined by a combination of company and personal objectives.

The members of the Group Management Team do not have personal remuneration schemes based on shares or options or other special rights entitling them to shares.

The members of the Group Management Team may participate in the company's long-term share-based commitment and incentive plan ("share plan") as decided by the Board of Directors. Under the share plan, participants have the opportunity to earn shares in Fondia Plc based on performance criteria set by the Board of Directors related to the financial and strategic performance of the company. Members of the Group Management Team have so far participated in the first vesting period 2022–2024 and the third vesting period 2024–2026 of the share plan.

The share plan is performance-based and consists of performance periods of three financial years. For both the 2022–2024 and 2024–2026 performance periods, awards are based on the development of the Fondia Group's EBIT and total shareholder return (TSR) during the performance period. For each of the two performance periods, the maximum number of shares that can be received by a member of the Group Management Team participating in the plan is 10 133 Fondia shares. In accordance with the terms of the plan, the performance shares payable on achievement of the targets will be settled at the end of the performance period by the end of May 2025 for the 202–-2024 performance period and by the end of May 2027 for the 2024–2026 performance period.

In order to participate in the share plan, a member of the Group Management Team is obliged to invest an amount equivalent to one month's salary in shares of the company. A member of the Group Management Team must own at least one quarter of the shares he or she receives as remuneration under the share plan until the total value of his or her shareholding in the company equals half of his or her annual salary for the previous year. This number of shares must be held for as long as his membership of the Group Management Team continues.

The members of the Group Management Team are entitled to participate in the share savings plan for employees of the Fondia Group in accordance with its terms.

The notice period for members of the Group Management Team is between two and six months. The members of the Group Management Team have no agreement on supplementary pensions.

Archive

Remuneration reports 2017-2022 are available in Finnish:

Palkka- ja palkkioselvitys 2019